Why Buyer’s Agent’s Won’t Give Feedback

In the world of real estate, communication is key. Buyers and sellers rely on their agents to keep them informed and provide feedback throughout the buying or selling process. However, it is not uncommon for buyers to find themselves in a situation where their agent is reluctant to share feedback. This can be frustrating for sellers, but there are valid reasons why buyer's agents may choose to withhold feedback. A buyer's agent may choose not to share feedback is to avoid disclosing confidential information. During the course of a transaction, even the showing, agents will become privy to information about the buyer, such as their motivation to buy, how much they love a house or why a house may or may not fit their needs. Sharing this information with the buyer could put the agent in a difficult position, as they have a duty to act in the best interest of their client. By keeping certain information confidential, the agent can maintain their professional integrity and protect the interests of both their client Also providing feedback can sometimes lead to unnecessary disputes or conflicts. Real estate transactions can be emotional and personal, and feedback can sometimes be taken personally by the seller. If the buyer's agent shares negative feedback about the property with their client, it could create tension between the buyer and seller, making it more challenging to negotiate or come to an agreement. To maintain a harmonious transaction and avoid unnecessary conflicts, some buyer's agents may choose to withhold feedback altogether. It's important for buyers to understand that while feedback can be valuable in some cases, there are situations where it may not be in their best interest to receive it. Instead, buyers trust that their agent is acting in their best interest and making informed decisions based on their expertise and knowledge of the market. A competent buyer's agent will carefully navigate the negotiation process and provide guidance and advice without relying solely on feedback.

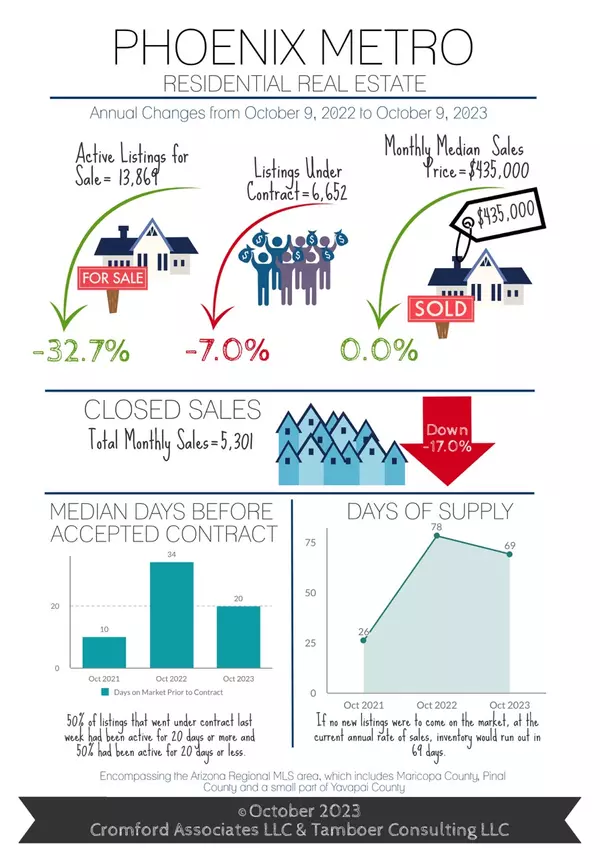

October 2023 Market Update from The Cromford Report

This is directly from the bery trusted resource of The Cromford Report Guess what? If you thought you missed the boat on buying a house last year, guess again! The Greater Phoenix housing scene is just about to hit that sweet spot – a balanced market. Sure, 18 cities are still playing hard to get with their seller’s markets, but hey, there are 11 cities waving the ‘Buyers Welcome’ flag. So, what’s the real deal with a buyer’s market? Most folks think it's all about dropping house prices, but that's not the whole story. Before you see any dip in sales prices, you'll spot list prices getting friendlier and sellers dishing out more incentives. In the last couple of months, as mortgage rates did their rollercoaster thing, hitting 8%, we saw a 33% jump in price reductions. And get this – sellers are now offering incentives up to $9,900. That's not just a new record for November, it's a gift to buyers, especially in the $300K-$400K range. But, and it's a big but, no one knows how long this will last. Mortgage rates are like that one unpredictable friend – they’ve dropped a bit recently, but who knows what’s next? There are whispers that the Fed might stop hiking rates soon. If that happens, these buyer-friendly times might just be a flash in the pan. Long story short, if you're looking to buy, keep your eyes peeled and your sneakers on this November and December. When 2024 rolls around, everyone and their dog will be back in the home-buying game. Now, for my sellers out there, let’s keep it real. This is not the time to play 'Guess How Much My House Is Worth.' The outskirts of town are already shifting to a buyer's market – Surprise, Litchfield Park, you know who you are. And the rest are likely to follow. Traditionally, the end of the year isn’t the best time to list, but with the market changing day by day, waiting for the new year might not be the golden ticket it usually is. More competition, more time waiting for a sale, and possibly more price cuts are on the horizon. The wild card? Those ever-changing mortgage rates. For those who need to sell now, you might still get your price, but it could cost you more with these high rates. It's not the dream market, but it’s the one we're dancing with at the moment. Big thanks to Tina Tamboer, the wizard of housing analysis from The Cromford Report, for these insights! ©2023 Cromford Associates LLC and Tamboer Consulting LLC

Appraisal vs Inspection - Common Misunderstanding

The world of real estate can often be confusing, especially for first-time buyers. Terms like appraisal and inspection can easily get mixed up, leading to misunderstandings during the transaction process. While both are important steps in the buying process, they serve different purposes and offer distinct advantages. In this blog post, we aim to clarify the difference between appraisal and inspection, ensuring that buyers understand these crucial aspects of the home buying journey. Let's start with the basics. An appraisal is an evaluation of the property's value conducted by a certified appraiser. The primary purpose of an appraisal is to determine the fair market value of the home being purchased. The appraiser will consider factors such as the property's condition, location, size, comparable sales, and market trends to reach an accurate valuation. This information is vital for both the buyer and the lender. The lender needs assurance that the property's value justifies the loan amount, while the buyer wants to ensure they are not overpaying for the home. On the other hand, a home inspection is a thorough examination of the property's condition. It is typically conducted by a licensed home inspector who evaluates the structural integrity, systems, and overall functionality of the home. The inspection covers areas such as the foundation, roof, plumbing, electrical, HVAC, and more. The purpose of the inspection is to identify any potential issues or defects that may affect the property's value or the buyer's decision to proceed with the purchase. It gives the buyer an opportunity to make an informed decision and negotiate repairs or adjust the purchase price accordingly. While both appraisal and inspection contribute valuable information to the buyer's understanding of the property, their focus and scope differ significantly. An appraisal primarily looks at the value of the property, whereas an inspection focuses on its condition. It's important to note that an appraisal is often required by the lender to secure financing, while an inspection is not mandatory but highly recommended for the buyer's peace of mind. Another key distinction is the party responsible for each process. The buyer typically pays for the home inspection and hires the inspector directly. In contrast, the appraisal is usually ordered by the lender, who assigns a licensed appraiser to conduct the evaluation. However, the buyer is responsible for the appraisal fee, which is typically included in the closing costs. In summary, an appraisal determines the market value of the property, ensuring that the buyer isn't overpaying for their new home and that the lender is satisfied with the loan amount. On the other hand, a home inspection examines the condition of the property, helping the buyer make an informed decision and negotiate repairs or adjustments as necessary. It's essential for buyers to understand the difference between appraisal and inspection to navigate the real estate process successfully. While both play a crucial role in protecting the buyer's interests, they serve distinct purposes. By seeking the services of a reputable appraiser and licensed home inspector, buyers can make informed decisions, ensuring they are making a sound investment in their new property. So, remember, when it comes to appraisal vs. inspection, know the difference and make the right choices for your real estate journey.

Categories

Recent Posts