Why Buyer’s Agent’s Won’t Give Feedback

In the world of real estate, communication is key. Buyers and sellers rely on their agents to keep them informed and provide feedback throughout the buying or selling process. However, it is not uncommon for buyers to find themselves in a situation where their agent is reluctant to share feedback. This can be frustrating for sellers, but there are valid reasons why buyer's agents may choose to withhold feedback. A buyer's agent may choose not to share feedback is to avoid disclosing confidential information. During the course of a transaction, even the showing, agents will become privy to information about the buyer, such as their motivation to buy, how much they love a house or why a house may or may not fit their needs. Sharing this information with the buyer could put the agent in a difficult position, as they have a duty to act in the best interest of their client. By keeping certain information confidential, the agent can maintain their professional integrity and protect the interests of both their client Also providing feedback can sometimes lead to unnecessary disputes or conflicts. Real estate transactions can be emotional and personal, and feedback can sometimes be taken personally by the seller. If the buyer's agent shares negative feedback about the property with their client, it could create tension between the buyer and seller, making it more challenging to negotiate or come to an agreement. To maintain a harmonious transaction and avoid unnecessary conflicts, some buyer's agents may choose to withhold feedback altogether. It's important for buyers to understand that while feedback can be valuable in some cases, there are situations where it may not be in their best interest to receive it. Instead, buyers trust that their agent is acting in their best interest and making informed decisions based on their expertise and knowledge of the market. A competent buyer's agent will carefully navigate the negotiation process and provide guidance and advice without relying solely on feedback.

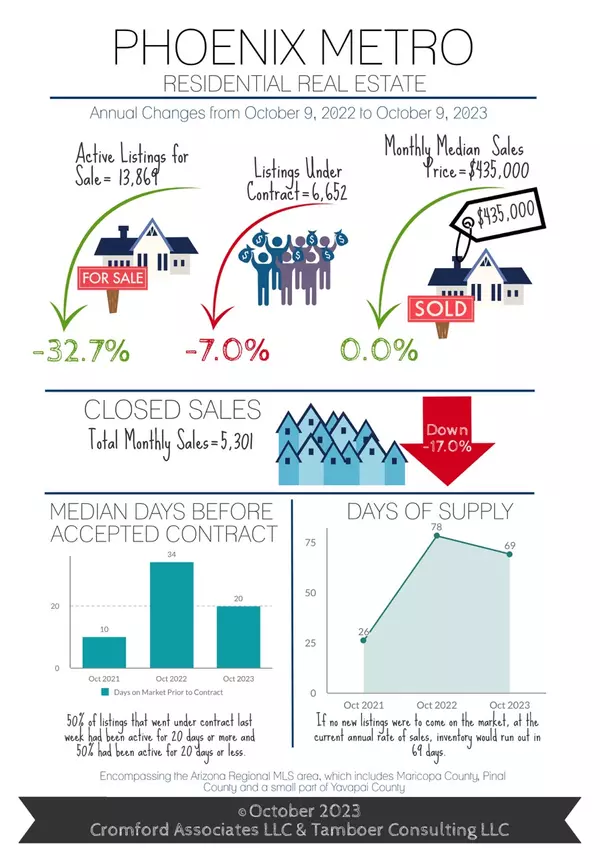

October 2023 Market Update from The Cromford Report

This is directly from the bery trusted resource of The Cromford Report Guess what? If you thought you missed the boat on buying a house last year, guess again! The Greater Phoenix housing scene is just about to hit that sweet spot – a balanced market. Sure, 18 cities are still playing hard to get with their seller’s markets, but hey, there are 11 cities waving the ‘Buyers Welcome’ flag. So, what’s the real deal with a buyer’s market? Most folks think it's all about dropping house prices, but that's not the whole story. Before you see any dip in sales prices, you'll spot list prices getting friendlier and sellers dishing out more incentives. In the last couple of months, as mortgage rates did their rollercoaster thing, hitting 8%, we saw a 33% jump in price reductions. And get this – sellers are now offering incentives up to $9,900. That's not just a new record for November, it's a gift to buyers, especially in the $300K-$400K range. But, and it's a big but, no one knows how long this will last. Mortgage rates are like that one unpredictable friend – they’ve dropped a bit recently, but who knows what’s next? There are whispers that the Fed might stop hiking rates soon. If that happens, these buyer-friendly times might just be a flash in the pan. Long story short, if you're looking to buy, keep your eyes peeled and your sneakers on this November and December. When 2024 rolls around, everyone and their dog will be back in the home-buying game. Now, for my sellers out there, let’s keep it real. This is not the time to play 'Guess How Much My House Is Worth.' The outskirts of town are already shifting to a buyer's market – Surprise, Litchfield Park, you know who you are. And the rest are likely to follow. Traditionally, the end of the year isn’t the best time to list, but with the market changing day by day, waiting for the new year might not be the golden ticket it usually is. More competition, more time waiting for a sale, and possibly more price cuts are on the horizon. The wild card? Those ever-changing mortgage rates. For those who need to sell now, you might still get your price, but it could cost you more with these high rates. It's not the dream market, but it’s the one we're dancing with at the moment. Big thanks to Tina Tamboer, the wizard of housing analysis from The Cromford Report, for these insights! ©2023 Cromford Associates LLC and Tamboer Consulting LLC

The Benefits of Homeownership

Homeownership is a dream for many people around the world. It offers numerous advantages and benefits that can greatly enhance one's life. Whether you are a first-time buyer or have experience in the real estate market, understanding the benefits of homeownership can help you make an informed decision. In this blog post, we will discuss the advantages of homeownership from various perspectives, including buyers, mortgages, and lifestyle. Buyers: One of the biggest advantages of owning a home is the security it provides. Unlike renting, homeownership ensures that you don't have to worry about moving when a landlord decides to sell the property. You have control over your living space, allowing you to settle down and establish roots in a community. Homeownership provides stability, which is especially important for families and individuals looking for a long-term living arrangement. Mortgage: While many people might associate a mortgage with financial burdens, it actually offers significant benefits. One of the primary advantages is building equity in your home. As you make mortgage payments, you are increasing your ownership stake, which can be seen as a form of forced savings. Over time, the value of your home is likely to appreciate, further building your wealth. Additionally, mortgage interest is tax-deductible in many countries. This means that a portion of your mortgage payment can be deducted from your taxable income, reducing your overall tax liability. These tax benefits can provide significant savings, making homeownership an attractive option for many. Lifestyle: Owning a home offers numerous lifestyle benefits that can enhance your overall quality of life. Firstly, you have the freedom to personalize and customize your living space according to your preferences. From painting the walls to remodeling the kitchen, you have the creative freedom to turn a house into your dream home. Moreover, owning a home often means being part of a community. You can develop relationships with your neighbors, participate in neighborhood events, and take pride in being a member of a close-knit community. Homeownership provides a sense of belonging and a place to call your own. Furthermore, homeownership can offer stability for families, especially those with children. Owning a home within a certain school district allows you to provide your children with a consistent education and a sense of belonging within their school community. In conclusion, the benefits of homeownership are vast and varied. From the security of not having to move when a landlord sells to the tax benefits associated with mortgage interest deductions, homeownership provides numerous advantages. Furthermore, owning a home allows you to personalize your living space, build equity, and become an active member of a community. If you are considering buying a home, it is important to weigh these benefits against your personal circumstances and financial goals. Homeownership is a significant investment, but one that can greatly enhance your life and provide a solid foundation for your future.

Categories

Recent Posts